tax per mile reddit

The infrastructure bill does not impose a mileage tax. In Hawaii drivers pay 16 cents a gallon in state gas tax most of which goes to highway maintenance.

The New Break Even Cost Per Mile For Truck Owners R Freightbrokers

The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed.

. We do pay per mile. Conversely Italy reinforced its commitment to an electric future by distributing 650M 688M USD in tax breaks to electric vehicle customers from 2022 to 2024. A vehicle mileage tax or vehicle miles traveled fee would charge motorists a fee based on how many miles they drive.

More efficient cars end up being nailed worse. The timing of a vote on a 12 trillion infrastructure package divided House Democrats this week. 005 per mile would end up as a massive increase in the taxes you are paying.

19 cents per mile. My wife started a new job and received a 10000 starting bonus. Log In Sign Up.

Posted by 7 years ago. The bill is sponsored by the states Department of Transportation. Standard Mileage Rate for Business The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax year to 56 cents per mile for 2021.

In 2019 Oregon lawmakers expanded their VMT program and prohibited cars that get fewer than 20 miles per gallon from participating in the program moving forward. Its called a fuel tax on every gallon of gas or diesel. Standard Mileage Rate for Medical Purposes.

However after a couple months she decided to go a different direction and left that job. My solution is not to find a way to tax them AND fuel vehicles by the mile plus gas tax. Search titles only.

A driving tax proposed by President Joe Biden would cost Americans 8 cents per mile. It would charge road users based on their class of vehicle with per-mile charges ranging from 13 cents for motorcycles and other. This includes 10 million each year from 2022 to 2026.

Rather this bill proposes a national motor vehicle per-mile user fee pilot program to study the impacts of. However electrics dont pay this taxfee and drive as many miles as they like on our roads for free. Yet the new per-mile user fee pilot outlined in section 13002 of the bill does leave those people open to tax vulnerabilities pegged to personal vehicle mileage.

Due to not fulfilling her contract she had to pay back the full 10k to the company even though she didnt actually. If your car gets 24 mpg now youd be paying 120 in tax based on mileage vs the 060 if paying per gallon. You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons.

Simply put if you drive a vehicle you would pay money to the government for every mile you drive. If those two divergent policies. Search all of Reddit.

A tax per mile. Americans should not allow GPS tracking of cars trucks. That comes to 80 a year for anyone who drives 10000 miles in a 20 mpg car.

The time period can vary but is typically a vehicle miles travel fee is measured in a one year period. Deductible business miles include driving to work-related functions meeting clients and going to job sites. A tax per mile.

Due to taxes she only received about 6800 of that money. I imagine if this is ever implemented even though we dont get to write off the miles we drive as employees for the 060mile that businesses can write off Id think thered be mileage tax writeoffs for miles we report as being used to drive tofrom work or driving for work. Aug 8 2021.

The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax year to 56 cents per mile for 2021. The infrastructure bill includes 125 million to fund pilot programs to test a national vehicle miles traveled fee. 54 cents per mile for business miles driven.

A vehicle mileage traveled fee can be used to raise revenue for.

Evs Of 2022 Msrp Per Mile Of Range After The 7 500 Tax Credit If Applicable Us Only R Teslalounge

Half Of The Us Population Lives In The 244 Super Dense Counties World History Map Map World History Lessons

Real Estate In 2022 Real Estate Tips Wholesale Real Estate Real Estate

Biden S New Vehicle Mileage Tax Program Will Charge Per Mile Driven Possibly Affecting Pizza Delivery Drivers Significantly R Talesfromthepizzaguy

Pay Per Mile Tax How Would It Impact You R Ukpersonalfinance

The Best Uber Driver In The World Awesome Uber Driving Uber Car Uber Driver

Irs Increases Mileage Rate To 58 5 Cents Per Mile For 2022 Grossman St Amour Cpas Pllc

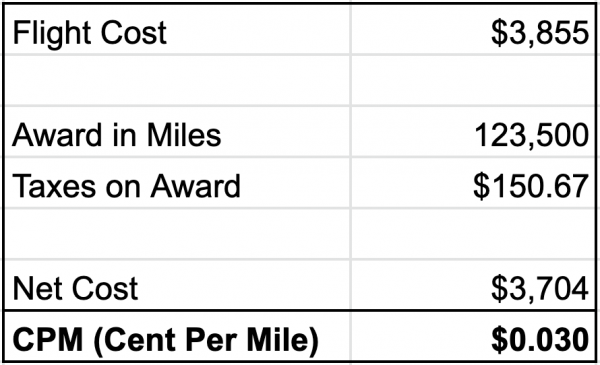

American Airlines Aadvantage Program A Guide Nerdwallet

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

How To Calculate Cost Per Mile Optimoroute

The True Cost Of Car Ownership The Best Interest

The True Cost Of Car Ownership The Best Interest

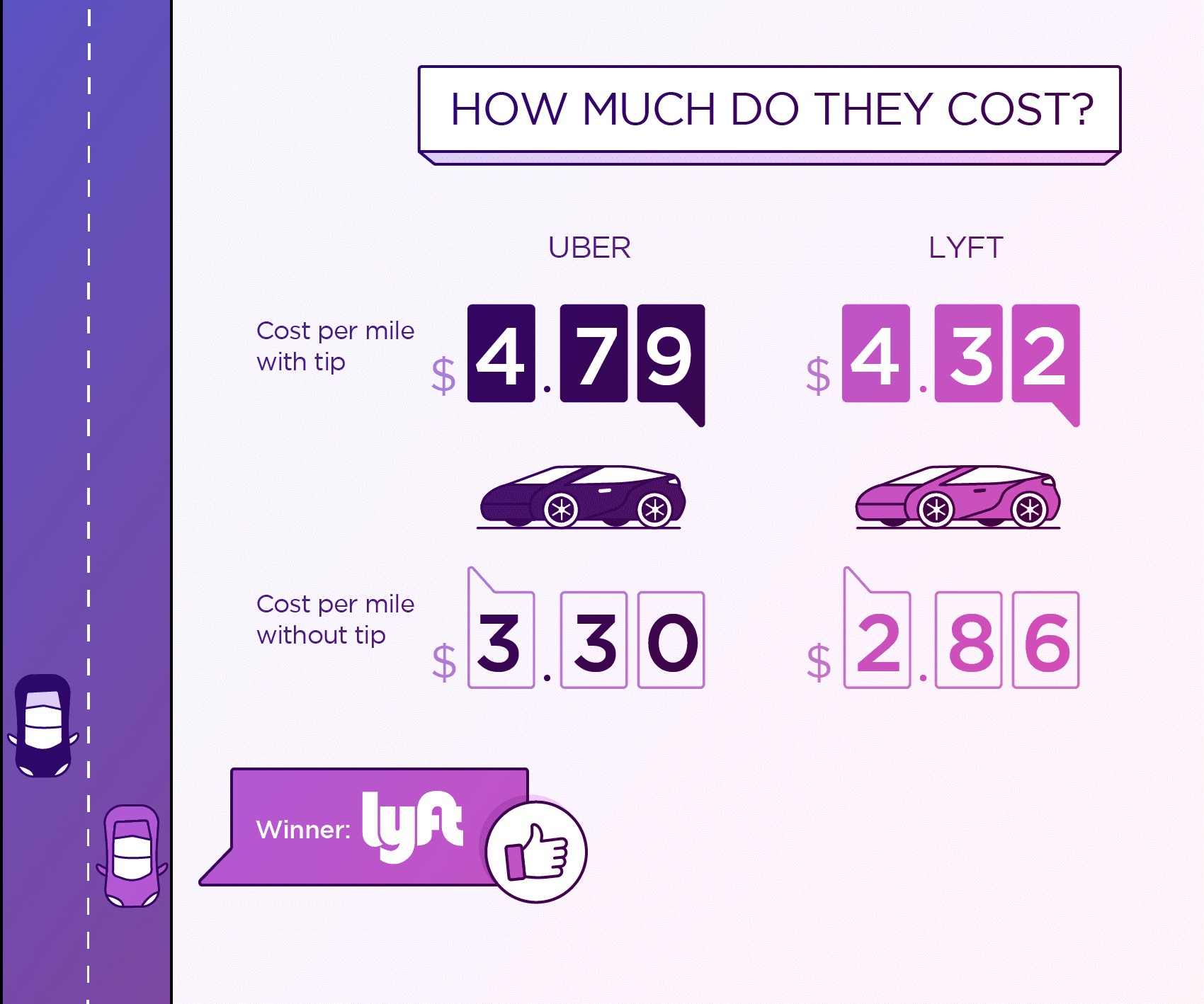

Uber Vs Lyft Infographic Uber Vs Lyft Lyft Uber

How To Calculate Cost Per Mile Optimoroute

What Pence Per Mile Should I Pay Business Motoring

Uber Vs Lyft Which Pays Drivers More Cashry

Government Looking To Tax Vehicles Per Mile In Future R Cartalkuk

The True Cost Of Car Ownership The Best Interest

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos